5 must-know blockchain trends for 2024 and beyond

Blockchain has been heralded as one of the revolutionary technologies of the 21st century, one poised to disrupt industries and transform how the world shares money and information.

Fifteen years after its debut with the advent of Bitcoin, the blockchain revolution has yet to fully materialize.

Instead, blockchain — like most new technologies — is advancing in fits and starts. The technology is bringing radical changes and enabling new business models in some sectors while sputtering along in others.

Tech experts, industry analysts and multiple reports in the past year have predicted more of the same. But they also stress that there is, indeed, plenty of forward momentum.

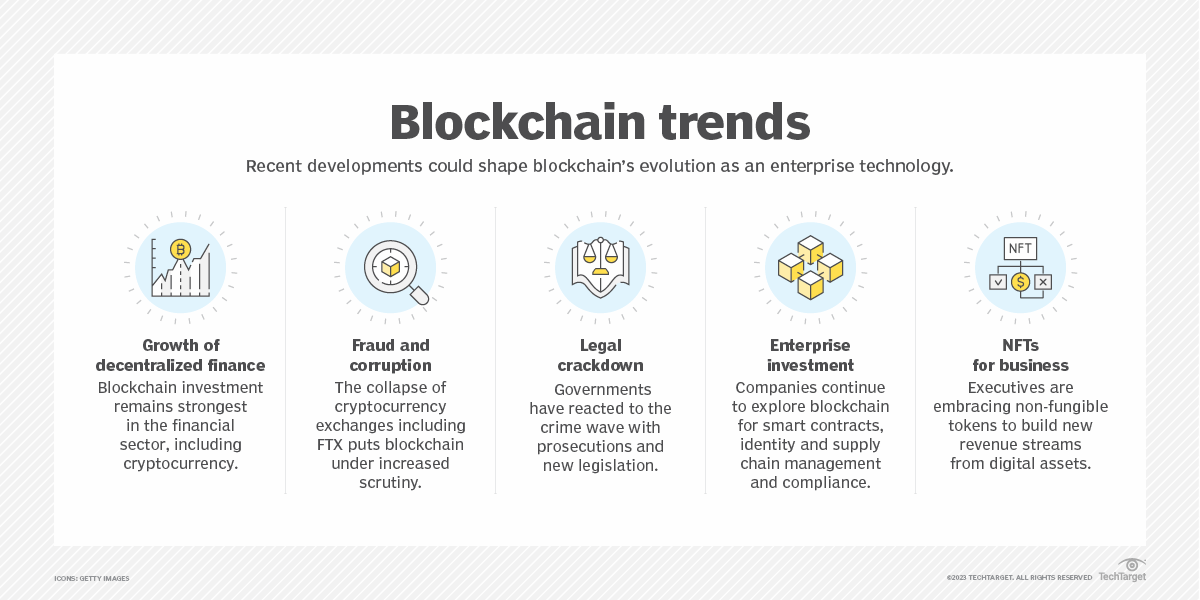

What’s on the horizon for 2024 and ensuing years? Blockchain projects will continue to advance in decentralized finance (DeFi), especially cryptocurrency, where the technology had its big breakthrough and continues to shine. But blockchain advancements are anticipated in other areas too. Top trends include the following.

1. Growth of DeFi

Interest and investments in blockchain remain strongest in the financial sector, according to analysts and industry research.

“We definitely saw cryptocurrency emerge as the killer app for blockchain,” said Avivah Litan, an analyst at Gartner.

But Litan said it’s not just the cryptocurrency market, which emerged since the 2009 arrival of Bitcoin that’s using the technology. Established financial institutions are using it too, seeing it as a key component for modernizing their infrastructure.

“They’re using blockchain for more transparent movement of assets and for fractionalization of assets,” Litan said, adding that blockchain is a great technology for both tracking and real-time settlement.

ReportLinker’s “Blockchain In Banking And Financial Services Global Market Report 2023” detailed the increased investments, calculating that the global market in blockchain banking and financial services grew from $1.89 billion in 2022 to $3.07 billion in 2023. The report sized up the market according to revenues earned by entities that offer both public and private blockchains and other blockchain services in banking and financial services.

Such numbers indicate what’s ahead, said Lata Varghese, managing director and practice leader of digital assets and blockchain at the consulting firm Protiviti. “The future of assets is digital,” she said.

2. Fraud and corruption dampen interest

Although the financial industry is continuing its investments in blockchain technology, the sector is also facing increased scrutiny and skepticism following a rash of negative news in the last two years.

There was the collapse of Terra, an open source blockchain platform in May 2022.

Then came the widely publicized collapse of FTX, at one point the third-largest cryptocurrency exchange, in late 2022. It was followed by the arrest of founder and former CEO Sam Bankman-Fried on various charges, including fraud. Early in 2023, crypto lender Genesis Global Capital filed for bankruptcy.

The anecdotal evidence is backed by statistics. The FBI’s “2022 Internet Crime Report” noted a rise in cryptocurrency investment fraud from $907 million in 2021 to $2.57 billion in 2022, an increase of 183%. Then in 2023, the FBI reported an increase in cryptocurrency investment scams, companies falsely claiming the ability to recover lost cryptocurrency investments, and fake non-fungible token (NFT) offerings that drained people’s cryptocurrency wallets.

That kind of news has an impact, Litan said.

“There is still innovation, but it’s stifling adoption,” she added. “It has an influence over the whole industry. People don’t get excited anymore. It just turns people off.”

3. Legal crackdown

Regulators and lawmakers are striking back in response to the crime and turmoil.

Proof in point: The legal steps taken last March by the U.S. Securities and Exchange Commission, which filed charges against crypto asset entrepreneur Justin Sun and three of his wholly owned companies for the unregistered offer and sale of crypto asset securities. The SEC also charged Sun and his companies with fraudulently manipulating the secondary market for the cryptocurrency token TRON (TRX) and for orchestrating a scheme to pay celebrities to tout TRX and another token, BitTorrent (BTT) without disclosing their compensation. The SEC also charged eight celebrities with illegally promoting TRX and BTT without disclosing that they were compensated for doing so and the amount of their compensation.

In February, the SEC charged Payward Ventures Inc. and Payward Trading Ltd. (both known as Kraken) with failing to register the offer and sale of their crypto asset staking-as-a-service program, a consensus mechanism for blockchain. Kraken agreed to pay $30 million to settle the SEC charges.

That came just a month after the SEC had charged cryptocurrency platform Nexo Capital with failing to register the offer and sale of its retail crypto-asset lending product. Nexo agreed to pay $45 million in penalties.

The agency brought several more actions against unregistered cryptocurrency products through the remainder of 2023. However, in January 2024, it approved the sale of spot bitcoin exchange traded products, a new type of investment vehicle that holds bitcoins and can be traded on the stock market.

The SEC isn’t the only entity taking action. U.S. lawmakers at both the state and federal level have proposed or filed legislation aimed at not only the cryptocurrency market but also blockchain as a technology.

Among such actions is a move made in March by U.S. Rep. Tom Emmer, R-Minn. The co-chair of the Congressional Blockchain Caucus introduced the Blockchain Regulatory Certainty Act. The bill, which passed in committee but has yet to be voted on by the full House, seeks to create legal clarity for blockchain developers and service providers who do not hold or manage consumer funds, essentially establishing that they should not be considered money transmitters subject to stringent regulation.

Meanwhile, several U.S. states have blockchain and cryptocurrency-related legislation pending in 2024.

4. Enterprise investments in blockchain

Despite all the recent turmoil in cryptocurrency, enterprise executives are still interested in blockchain, industry analysts said.

They’ve explored how blockchain can be used to create more effective, efficient and secure platforms for various business needs, including identity and access management, supply chain management, smart contracts, and document management and verification.

However, most organizations are only exploring ideas or experimenting with blockchain for those uses.

“I see people still interested in this, but we’re not seeing that adoption take off yet,” said Seth Robinson, vice president of industry research at CompTIA, an IT industry association.

Robinson said executives in most industries, particularly those outside the financial sector, have yet to see any platforms built with blockchain that justify the cost of replacing the systems they already have.

He said he expects enterprise use of blockchain to accelerate when software vendors figure out ways to use it to dramatically improve their products or to create new products and services that significantly help organizations.

“The vendors will have to show why the blockchain-based solution is better — and that it is so much better — that it’s worth ripping out and replacing what [companies] have in place,” he said.

However, there are some areas where enterprise executives are further along in their blockchain experiments or use.

Some organizations are using blockchain for compliance, particularly in the area of environmental, social and governance, or to bring more transparency to their supply chains. For example, some use blockchain for provenance to ensure raw materials are coming from acceptable regions.

5. NFTs for business

Although executives might not yet see the value of using blockchain for many business processes, more and more are embracing it as part of the online token-based economy. Specifically, they’re building new revenue streams by selling digital products and assets through NFTs.

“That’s where a lot of the innovation has been happening,” Varghese said.

The potential size of the market is staggering. In a 2021 research note, Morgan Stanley estimated that metaverse gaming and NFTs could represent a $56 billion revenue opportunity by 2030 for the luxury market alone.

Meanwhile, professional services firm Deloitte addressed the potential of NFTs for business in its 2022 report, “Corporates using NFTs: How NFTs might fit your business and what to watch for,” writing that companies are just beginning to scratch the surface of the technology.

Deloitte went on to conclude, “The more companies develop and test new use cases, the clearer it seems that NFTs in their many forms — current and future — may radically change the way we engage and record the transfer of digital rights and obligations, a development that could redefine the very nature and boundaries of modern commerce.”

Source : techtarget.com