Vietnam’s Renewable Energy Policies and Opportunities for the Private Sector

Clean EDGE Asia Fellow Nguyen Linh Dan provides an assessment of the factors shaping Vietnam’s renewable energy sector and the opportunities for private-sector engagement. She details domestic policies and strategies set by the government that are driving growth in the country’s renewable energy sector and considers the impact of international factors and options for increased cooperation with and investment from the private sector.

Vietnam is a dynamic emerging economy with almost 100 million people. Before the Covid-19 pandemic, the country used to experience 6%–7% of annual GDP growth, resulting in a dramatic rise in energy demand and greenhouse gas emissions. Given the forecasts for continuously high economic growth until 2030, rising energy demand will lead to severe power shortages if left unaddressed.[1]

Hydropower has been a clean, stable, and reliable source of energy for Vietnam, according to the APEC Energy Working Group’s Expert Group on Energy Data and Analysis; however, the share of hydropower in the country’s power mix has been shrinking (from 37% in 2019 to 30% in 2020) due to saturation.[2] Reservoir capacity constraints mean that hydropower is unable to meet growing demand. Fossil fuels (coal, gas, and oil) now contribute around half of the generation mix. Coal has been the cheapest and most available source of supply, but Vietnam has become increasingly reliant on imports. Meanwhile, renewables, including small hydropower, solar, wind, and biomass, account for only 16% of power generation.

In 2015, the government announced the first-ever national development strategy for renewable energy, aiming for renewables to account for around 32% of total primary supply and electricity generation by 2030. The solar power development plan (first announced in 2017 and updated in 2020), along with feed-in tariff (FIT) revision of wind, aims to generate as many as 18.9 gigawatts (GW).[3] This is far more than the 1,000 megawatt (MW) target originally set a few years ago for 2020.

This massive increase in solar capacity during 2019–20 has affected power system operations significantly. Major challenges include ramping up power generation to meet demand through variable renewable energy and adding responsive transmission lines in a short time with a limited budget. As oversupply poses a major threat to the security of the national grid, many solar projects were forced into wasteful curtailment, and thus were unable to pay bank debts on time. In addition, the lengthy Covid-19 lockdown caused a large reduction of loads in conjunction with unexpected demand, not to mention disruptions to the supply chain. Although incoming investors have a lot of incentives to join the market, they are still not confident enough to make investment decisions. Therefore, stakeholders are closely watching all related regulations and their revisions.

This essay provides an assessment of the factors shaping Vietnam’s renewable energy sector and the opportunities for private-sector engagement. It first details domestic policies and strategies set by the government that are driving growth in the country’s renewable energy sector. It then considers the impact of international factors, including the Covid-19 pandemic, on this growth. Finally, the essay concludes by considering options for increased cooperation with and investment from the private sector.

FACTORS SHAPING RENEWABLE ENERGY GROWTH IN VIETNAM

Vietnam is a socialist republic with a one-party system led by the Communist Party of Vietnam, with the Politburo serving as the highest decision-making body in the country.[4] The Politburo oversees the party and its resolutions have a significant impact on the government’s policies and strategies, including in the energy sector. Coming thirteen years after the latest versions of the national energy development strategy and outlook (Resolution No. 18-NQ/TW of 2007, followed by Decision No. 1855/QD-TTg in the same year), the Politburo’s Resolution 55 (2020) came as the most comprehensive and leading-edge guidance in the rapidly changing energy field. All relevant legal documents have been revised based on the spirit of the resolution.

“In the next 10 to 25 years, the government aims to increase new and renewable energy up to 30% of the total primary supply.”

Resolution 55 sets the following goals for the “National Energy Development Strategy to 2030 with a Vision to 2045”: (1) to maintain the national energy security as the firm foundation for socioeconomic development while rapidly and sustainably developing the energy sector; (2) based on the socialist-oriented market mechanism, to quickly develop a competitive and transparent energy market, diversify forms of ownership (especially the private sectors) and business models, and eliminate monopolies or unfair competition; (3) to develop and diversify energy forms; (4) to accelerate digital transformation and R&D in order to become more technology self-sufficient; and (5) to emphasize energy efficiency and environmental protection.

The third key viewpoint related to the energy supply share in Resolution 55 can be analyzed into the following elements:

- Energy diversification to develop various types of energy in a reasonable manner.

- New, renewable, and clean energy to prioritize the exploitation and efficient use of renewables to their fullest potential

- Domestic fossil energy to judiciously exploit and use

- Energy stabilization, reservation, and stocking to ensure the implementation and oil stoking obligations

- Prioritization of gas-fired power development

- Gradual reduction of the share of coal-fired power

- Imports to meet sufficient demand of power plants

- A national energy system to optimally allocate the supply of all sources based on the advantages of each region and area at the local level

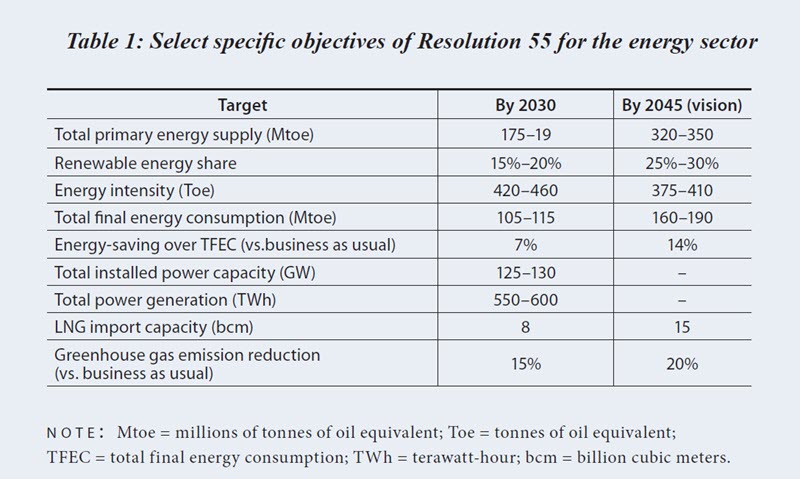

In the next 10 to 25 years, the government aims to increase new and renewable energy up to 30% of the total primary supply (see Table 1). The baseload solution is expected to rely on natural gas or imported liquefied natural gas (LNG). Coal share will be reduced due to changes in social cost performance, as coal receives more societal opposition due to its environmental impact. Additionally, since becoming a net coal importer in 2016, Vietnam relies on the international market, where prices are constantly increasing, furthering social opposition to coal in the domestic market. The supporting infrastructure for LNG imports is being progressively developed. The first facility—the Thi Vai complex, with a capacity of one million metric tonnes—is expected to be completed in early 2022. Potential trading partners include Australia, Qatar, the United States, Russia, the Middle East and North Africa, or other Southeast Asian countries, but the names of foreign suppliers have not yet been revealed.[5]

There has been no mention of a future restart of plans to build nuclear power plants after construction was halted in 2016. Nuclear power can be listed under clean, zero-carbon energy, together with renewable energy, because it is generated without carbon dioxide byproducts. The main issues that hinder its development in Vietnam are the huge investment cost, hazardous waste, lengthy construction time, and other management or knowledge-transfer concerns.[6]

Resolution 55 also highlights and paves the way for the private sector, including foreign investors, to participate in the electricity market, which has long been monopolized by Vietnam Electricity. The resolution targets a more diversified, transparent, and digitalized buying-selling mechanism. It states that Vietnam should “continue to promote and attract foreign investment on a large scale and with high quality and efficiency” and “create an open investment regime and reform administrative procedures to ensure the progress of power projects.” The ultimate goal is to ensure a secure, sufficient, and sustainable supply at a reasonable price for the long term.

THE NATIONAL POWER DEVELOPMENT PLAN

The National Power Development Plan 8 (PDP8) and the National Energy Master Plan for the Period 2021–2030, Vision 2050, are being drafted roughly at the same time. Vietnam has never had an all-inclusive energy plan that covers energy use in demand sectors. In the past, the power sector was always a top priority. The PDP8 still draws slightly more attention from the public as the share of fuel input to the power system continues to change with the increasingly high penetration of renewable energy in recent years. Other sectors like industry, transportation, and building are gradually making their way into the master plan, although they still struggle with data collection for demand.

The implementation of the PDP7 has revealed shortcomings and limitations in planning capacity, such as risk management challenges and inflexibility to change, including cancellation of nuclear power plants, higher renewable shares, and diversified stakeholders in the market.[7] Now that the power structure has changed, especially since the penetration of renewable energy, many power projects are behind schedule or have not been implemented. Emerging environmental protection issues and the involvement of the private sector have sparked a lively discussion on how the new strategies are formed. The drafting of the PDP8 started in late 2019 and went through public review several times. The government conducted a further review after the 15th National Assembly in mid-2021.

In the latest draft dated September 2021, total installed capacity is reduced by 7.7 GW, with renewable energy being decreased and coal being slightly increased from the March draft. This change has sparked a disagreement from pro–renewable energy groups. The Vietnam Sustainable Energy Alliance, for example, sent four recommendations to this draft version, stating that the PDP8 should (1) continue to promote renewable energy against its current shortcomings, (2) reconsider the 16.4 GW of coal-fired power projects with low feasibility and limited local support and financing, (3) encourage the private sector to engage strongly in grid and environmentally friendly Battery Energy Storage System (BESS) development, and (4) craft a more detailed budgeting and deregulating plan. The share of each energy source still stays within an acceptable range as stated in Resolution 55, and the share of coal is significantly reduced compared with the PDP7.[8] High installed capacity of renewable energy is not the decisive factor in planning; instead, balancing between baseload and variable power should be taken seriously to ensure energy security.

AFTER FIT AND THE DIRECT POWER PURCHASE AGREEMENT (DPPA) MECHANISM)

After the first feed-in-tariff for solar energy, which was priced as high as 9.35 US cents per kilowatt hour (kWh), ended in June 2019, FIT2 (priced at 8.38 US cents/kWh exclusively for solar rooftops) was available for projects that could commence by the end of December 2020. Since then, the government has been reviewing whether a lower FIT3 (5.2–5.8 US cents/kWh based on system size), a flexible tariff with constant discounted percentage, or other incentives should be implemented. In the most recent discussion, the auction and self-consumption scheme were emphasized. FIT showed itself appropriate for renewable promotion during its launch period, yet it remains associated with management and transparency problems.

Vietnam is also developing the DPPA mechanism as an alternative for the long-term benefit of all parties. It is widely recognized and successfully practiced in many developed countries and enjoys strong support from giant international corporations such as Apple, Google, and Amazon. The mechanism helps industrial customers negotiate a more favorable price for electricity than that offered from the traditional grid. It is a solution for renewable energy producers facing curtailment or with excess output. The burden to the national transmission lines or pressure on Vietnam Electricity from mandates to buy renewable energy would lessen. The DPPA mechanism could create fairer competition in the retail electricity market, contributing to the sustainable development of renewable energy sources. Direct investment from international organizations with high environmental commitments may increase accordingly.

The much-awaited circular guiding implementation of a DPPA pilot program between private renewable power generation companies and power consumers was released in April 2021. Eligible applications are required to meet several conditions:

- The power plant project must be limited to wind or solar plants of greater than 30 MW and approved in the power development plan.

- Electricity must be purchased at 22 kilovolts or more.

- The project must reach commercial operation no later than 270 working days from the selection date.

- The project must commit to an agreement with power consumers to buy at least 80% of the recent year’s demand in the first three years.

Newcomers to the market are likely unable to participate in this pilot program because of its short timeline and limited target. It will be implemented nationwide from 2021 to 2023 on a small scale of 1,000 MW in total and only aims at projects approved in the revised PDP7. Those who failed to commence their solar project before the FIT2 program ended are queuing for the application. In the event that the applications received exceed the limit of 1,000 MW, those who participate in the early bird registration have a higher chance of selection. However, the detailed selection process is not yet clear to the public. Big players like Samsung have expressed their wish to join directly with the Ministry of Industry and Trade, but no confirmation from the government has been announced. If such special treatment is allowed, smaller businesses will have even fewer opportunities to join the market soon, and the monitoring of the pilot phase will involve more complexity.

THE IMPACT OF THE COVID-19 PANDEMIC

As the year of wind’s FIT regime, 2021 was the last year of wind power over solar projects, whose FIT program ended December 2020. After the 8.5 US cents/kWh subsidy program ended on November 1, 2021, FIT could decline by 12%–17% in a business-as-usual scenario. In another proposal, FIT could be replaced by an auctioning program. This has worried many businesses and investors in the renewable energy sector with prolonged difficulties. The implementation of FIT was from the beginning delayed due to the absence of execution guidelines after the effective date of the Decision 39 on the supporting mechanism to develop wind energy in Vietnam (November 2018).[9] Furthermore, offshore wind power projects often take an extended time to develop.

“International disruption of the supply chain has limited the availability of wind power equipment and affected the progress of projects.”

The Covid-19 pandemic has worsened the situation since 2020. International disruption of the supply chain has limited the availability of wind power equipment and affected the progress of projects. Imported parts have needed to go through multiple quarantine periods while transportation has been limited. Other severe social-distancing policies during the last valid months of the FIT program delayed the planned commercial operation date of November 1, 2021, for many related projects. Local governments in Binh Thuan, Soc Trang, and Tra Vinh appealed for a FIT extension several months in advance but did not receive approval from the central government. The Ministry of Industry and Trade said that the incentive period should be fixed to motivate potential investors, and that an extension is thus not fair to those who met the deadline. Besides, turbine and auxiliary service costs are declining, and an extension might lead to a deficiency in the state budget.[10] As a result, 62 projects of almost 3.5 GW have fallen behind.

Unclear, inconsistent policies and roadmaps increase risks and discourage investors in wind power. As seen in Vietnam, these factors are all the more pronounced during a public health crisis like the Covid-19 pandemic.

POLICY OPTIONS TO ENHANCE THE PARTICIPATION OF THE PRIVATE SECTOR

The government should make sure that the mechanisms and policies of Resolution 55 and related decisions about FIT are consistently implemented, encouraging domestic and foreign investors and stakeholders to participate in energy development through regular inspections and monitoring. The Ministry of Industry and Trade should also enable more transparent approval procedures to prevent project cancellation and unregulated purchases.

A transparent process is required for decisions on curtailing renewable energy. In 2021, at least 1.3 GW hours are estimated to have been cut off from the grid, and the number may have been higher due to the limited capacity of the transmission system and reduced demand. In October 2021, mainly because of the Covid-19 pandemic, daily consumption only accounted for up to 40% of the nationwide installed capacity.[11] Regardless of whether “must-run” policies for renewables are implemented or not, a huge amount of capacity is being wasted, resulting in a big burden for projects’ internal rate of return. Developers are concerned about how and when their output will be curtailed, and if all projects will be treated in the same way.

Also due to the Covid-19 pandemic, as well as natural disasters in a number of central provinces, transportation and implementation of wind power projects have been delayed significantly. If the FIT program cannot be extended, an alternative mechanism should be put in place as soon as possible. Regulations for auctions, power purchase agreements, or incentives for self-consumption of industries or for demand response need an official agenda.[12] In the case of ongoing projects affected by the pandemic, relevant authorities should coordinate with banks to extend loans when necessary.

“Pumped storage hydropower can be considered suitable for Vietnam’s energy system, which still relies heavily on coal and hydroelectricity.”

For a longer-term solution, energy storage is key to pursuing a higher share of renewable energy. Apart from expensive options such as hydrogen and carbon capture and storage, pumped storage hydropower can be considered suitable for Vietnam’s energy system, which still relies heavily on coal and hydroelectricity. Battery storage would also help boost the penetration of variable renewable energy. Therefore, supporting policies and circulars should encourage investment in energy storage, especially for the more flexible battery storage. Currently, the initiative is supported by the U.S. government’s funding for a utility-scale solar farm with an almost $3 million grant for the BESS system pilot project in central Vietnam.[13] A few other research projects are being conducted by Asian Development Bank, GIZ, Vietnam Electricity, and Japan’s Ministry of Economy, Trade, and Industry, showing dynamic interest from various stakeholders in this field.

Policies should also focus on developing more stable sources of renewable energy besides the variable options. Waste-to-energy, for example, would achieve the dual goals of urban waste management and net-zero emissions, but thus far it has not received much attention. Although this option would require a more complex, interministerial action plan related to waste classification, waste-to-energy is possible for Vietnam if well planned.

CONCLUSION

Vietnam is now in the middle of an energy transition. A series of energy policies are under review, which once decided will shape the energy development pathway of the country for at least the next decade. Following the prime minister’s commitment to a net-zero economy by 2050 at the UN Climate Change Conference in November, this period of time becomes particularly important for competent agencies to reconfirm their energy development trajectories so as to meet these ambitious targets.[14]

As part of this process, market liberalization with the participation of the private sector will be crucial to the sustainable development of the energy system. The private sector includes not only domestic enterprises but also domestic households on a large scale and foreign players.

The after-FIT incentive mechanism for renewable energy, especially the financial scheme for operating projects, will determine the next steps for investors. This mechanism needs to cover change that might happen in the long term and be specific in content, but also flexible enough to prevent the difficulties discussed above. The role of the government is to take the lead in infrastructure development by providing the most transparent regulations possible with sufficient penalties or compensation to encourage investment.

Source : nbr.org