Here’s How Supply Chains Are Being Reshaped for a New Era of Global Trade

Nearshoring. Automation. Supplier diversification. Sustainability. Companies are adapting their operations to changing market pressures and geopolitics.

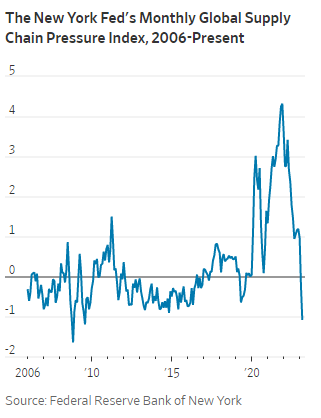

When a measure of strains on global supply chains fell earlier this year to levels last seen before the Covid-19 pandemic, it signaled to some that the product shortages, port bottlenecks and shipping disruptions of the past three years were over and that a new era of stability was on the horizon.

But industry experts say a “return to normal,” as the Federal Reserve Bank of New York described its Global Supply Chain Pressure Index in February, hardly means that companies are going back to conventional, some would say complacent, supply chains.

Instead, say academics and consultants, the experiences during the pandemic, along with changes in geopolitics, are leading to broader, potentially long-lasting changes in how companies manage the flow of goods, from the sourcing of raw materials to manufacturing and distribution.

The changes are playing out at factories in India, auto-assembly plants in northern Mexico, ports from the U.S. Southeast to East Africa and mineral mines in Canada and Sweden. The sites are where companies are implementing disciplines such as resilience, regionalization and supplier diversification that came to the forefront as they coped with the severe disruptions that began in early 2020.

The changes are playing out at factories in India, auto-assembly plants in northern Mexico, ports from the U.S. Southeast to East Africa and mineral mines in Canada and Sweden. The sites are where companies are implementing disciplines such as resilience, regionalization and supplier diversification that came to the forefront as they coped with the severe disruptions that began in early 2020.

The turmoil that began with the declaration of the Covid-19 pandemic first hit companies with sudden shortages of consumer staples as households locked down, was followed by factory shutdowns that interrupted the flow of goods and then hit transportation networks as an abrupt snapback in demand led to overstuffed ships and enormous backups at ports.

By April 2020, the New York Fed’s supply-chain stress index had shot up to double the level it reached during the recovery from the 2009 financial crisis. It finally fell back early this year to levels more typical of a measure going back 25 years.

“Some stresses have been taken off, there are fewer supply shortages, and things are a lot less hectic, but we certainly are not back to normal,” said Patrick Van den Bossche, a partner and global analytics practice leader at consulting firm Kearney. “There is a subdued level of urgency but a lot of things have changed.”

Diversifying supply sourcing

The changes on the surface include less reliance on Asia, particularly China, and the use of more automation technology to keep assembly lines and warehouse operations running.

Apple Inc. is shifting some smartphone production from China to India, toy maker Mattel Inc. is among companies expanding operations in Mexico, and even a Chinese manufacturer, Hisense Co., is looking to make appliances in Mexico for the U.S. market.

But there are more enduring changes, experts say, that will more broadly affect how companies get their raw materials and parts, where they produce goods and how they ship finished products to consumers. Taken together, the changes mark the biggest shift in how supply chains are managed since China’s entry into the World Trade Organization in 2001 ushered in a new era of globalization.

Apple is shifting some smartphone production from China to India and recently opened a store in Mumbai. PHOTO: DHIRAJ SINGH/BLOOMBERG NEWS – fetch form : wsj.com

Experts say postpandemic supply chains are being built with a focus on regionalization, with production closer to where companies expect to sell their goods. Companies are also moving to spread their base of suppliers around the world, moving away from single-sourcing, and they are adding automation to everything from warehousing operations to procurement decisions.

The shifts add up to a widespread effort to make supply chains more resistant to disruption.

“They have been moving away from a model built on scale, where everything is engineered to get the best financial impact from the greatest economies of scale, to a model where there is plenty of redundancy in the network,” said Mr. Van den Bossche.

“The move away from China, to rewire supply chains to where you have multiple local supply chains, is really just starting. Companies are still trying to figure out how this works,” he said.

Risks vs. rewards

Rick Gabrielson, a consultant and former senior transportation executive at Target Corp. and Lowe’s Cos., said many companies are looking hard at their sourcing strategies, including whether they have a heavy concentration of goods or components coming from one country or a single supplier.

Spreading out suppliers almost certainly adds costs, but Mr. Gabrielson said companies have to balance those costs against the potential for future disruptions.

“You have to ask yourself, which do you want? Are we going to minimize risk for shareholders and customers or are we going to minimize costs? This is the conversation that is taking place, but the change doesn’t happen overnight,” he said.

Heidi Landry, chief procurement officer for MedTech at Johnson & Johnson, told the University of Pittsburgh’s Supply Chain Management Symposium in March that the healthcare-products company is trying to better gauge risks in its global network of suppliers in the wake of pandemic disruptions. The program, she said, is aimed at “maintaining a continuous supply base and managing risk to enable global access to lifesaving medicine and equipment.”

New regulatory disclosures

Expanding environmental rules and the drive by companies to cut their carbon footprint is making that effort to diversify sourcing more complicated.

In the U.S., the Securities and Exchange Commission is advancing plans to require that companies disclose not only their own carbon emissions but those of their suppliers, and their suppliers’ suppliers—what is known as Scope 3 emissions.

“Sustainability adds complexity and it adds costs,” said Mr. Gabrielson.

Supply Chains Have Changed Forever

Nearshoring. Automation. Supplier diversification. Sustainability. Here’s how companies are reshaping their logistics.

The biggest casualty in supply-chain strategies during the pandemic may have been the just-in-time principle that has preached lean inventories to cut costs and improve efficiency in supply chains.

After lengthy product shortages and factory outages from Vietnam to the U.S. Midwest because of parts shortages, businesses from Nissan Motor Co. to PepsiCo Inc. have said the focus on hyper-efficient supply chains may be waning as more companies recognize the value in buffer stock.

Mr. Gabrielson said companies will adapt over time, taking on more safety stock while managing risk in other ways such as adding multiple suppliers. “You will not see the pendulum pull all the way back” to a just-in-time focus, he said.

Greater regionalization of production will also help minimize risks of shortages because the supply lines aren’t as long, he said.

‘The most important lesson’

Yossi Sheffi, director of the Massachusetts Institute of Technology’s Center for Transportation and Logistics, said the accelerated adoption of technology during the pandemic, as companies rushed to make and ship goods more quickly, will have a lasting impact on supply chains.

But the bigger impact will come, he said, as companies assess how they responded to the pandemic strains and adapted. Prof. Sheffi points to the consumer-goods companies that quickly reconfigured supply chains by trimming product lines, resetting sourcing and using other tools to rebound from early shortages.

“They learned a lot of things that they didn’t think were possible. This means companies can do more than they thought was possible,” he said. “They have learned how to be nimble, and that may be the most important lesson.”

Source : wsj.com