Logistics companies race to adapt to shifting supply chains

How are logistics companies responding to global supply chain shifts? Just follow the money.

Manufacturers are investing billions to build factories that are closer to consumers or in less risky alternatives to China in a push for increased supply chain resiliency after weathering years of political and pandemic-related disruptions.

These trends — known as reshoring, nearshoring and friendshoring — may cost shippers in the near term. But they stand to benefit from faster lead times and greater diversity in their distribution strategies as a result, said Brian Bourke, global chief commercial officer at SEKO Logistics, at an October media event.

There will need to be enough planes, trains, trucks and container ships to transport products out of shippers’ newly opened plants to realize these benefits. That’s something carriers are eager to provide amid a prolonged stretch of softer volumes and economic uncertainty.

Improved capabilities and network tweaks from Union Pacific, DHL Express, ZIM and others aim to capitalize on this geographic shift in demand. Examples range across transportation modes, from cross-border services connecting Mexico, the U.S. and Canada to new shipping routes out of Latin America.

As these logistics offerings improve, more factory groundbreakings are poised to follow.

“Across the board, companies identify logistics as the most important factor when deciding where to source materials from and make direct investments,” according to an October report from the U.S. Chamber of Commerce and Ipsos.

Ocean Network Express recently launched a shipping service connecting ports in South American cities like Cartagena to Florida. “Cartagena – Container Ship in Port” by Roger W is licensed under CC BY-SA 2.0 | Fetch from supplychaindive.com

Flexibility is key for ocean carriers

Ocean carriers have adapted to shifts in global trade demand for years, said Anders Schulze, SVP and head of Flexport’s ocean business, in emailed remarks.

“During the 2008 financial crisis, the industry faced a sudden drop in demand, and shipping companies responded by reducing capacity and implementing cost-saving measures,” Schulze said. “Similarly, when the Panama Canal expanded in 2016, it altered trade routes and required substantial investments in infrastructure to accommodate larger vessels.”

But carriers’ current adjustments are occurring more quickly in the past, Schulze said, noting ZIM’s recent relaunch of its expedited e-commerce line connecting South China to the U.S. West Coast.

ZIM told Supply Chain Dive that it “developed a distinctive agile strategy” years ago to respond to rapid changes in the market. Of late, it has expanded its connectivity from South America to the United States’ East Coast and Gulf Coast as a result of market changes and evolving customer needs.

“In some cases, decreasing demand has led to the closure or downsizing of specific lines, while the emergence of new or expanding markets has allowed us to introduce new lines and trades,” the company said.

Ocean Network Express (ONE) told Supply Chain Dive that it is also staying flexible and proactive to prepare for shifts in global trade flows. The shipping line recently downsized its U.S. and Europe services while launching new service routes within Asia and from Latin America. For example, it announced its “FLX” service in July, connecting South America’s west coast to Florida.

Ocean Network Express announced in July a new service called FLX, which connects South America’s west coast to Florida. Courtesy of Ocean Network Express | Fetch from supplychaindive.com

However, not every ocean carrier is pushing to launch new services. As the industry grapples with volatile demand trends, Hapag-Lloyd said in an emailed response that it is instead focusing on adapting its existing services to current demand.

“But of course, we see new evolving markets, which we integrate more into our existing network (like Africa or India),” it added.

DHL Express is investing heavily in Mexico to capitalize on the country’s growth. Hector Vivas via Getty Images | Fetch from supplychaindive.com

Air cargo eager to capitalize

Nearshoring or friendshoring a supply chain isn’t a straightforward endeavor — adjusting supplier networks, finding the necessary labor and adapting to another country’s regulations are just a few of the challenges involved.

“For manufacturers that move operations to Mexico from China, for example, they may still be relying on materials from suppliers in Asia or other sourcing locations,” Matt Castle, C.H. Robinson’s VP of global forwarding products and services, said in an email.

That’s where air cargo services come in handy. During a nearshoring transition period, shippers will often use air freight to quickly deliver supplier components to keep up with their new facilities’ production and inventory needs, Castle said.

The theme here is that as shippers are diversifying their supply chains to mitigate risks, agility is critical as disruption is truly unavoidable, and shippers historically turn to air to keep goods moving.

Matt Castle

C.H. Robinson VP of global forwarding products and services

Many businesses will be eager to tap into less expensive transportation modes like trucking or rail once that transition is complete, but air freight still offers upside for operations closer to their customers, Castle added. He noted air cargo “has been a quick, reliable pivot” for many automotive suppliers and OEMs to zip past congestion along the U.S.-Mexico border.

“The theme here is that as shippers are diversifying their supply chains to mitigate risks, agility is critical as disruption is truly unavoidable, and shippers historically turn to air to keep goods moving,” Castle said.

An air cargo industry forecast released last year by Boeing agrees with Castle’s assertion that nearshoring will benefit airlines. The aerospace giant said supply chain shifts are slated to spark a North American manufacturing resurgence, which will result in the making of high-value components that are typically transported by airplane.

This presents an opportunity for the air cargo industry to capture more volume as carriers, like their ocean counterparts, grapple with weak demand and tumbling freight rates. Many air cargo providers are already making investments to capitalize on this expected uptick.

DHL Express is investing a total of $600 million in Mexico by 2024 to capitalize on the country’s growth, its Americas CEO Mike Parra said on LinkedIn earlier this year. That doubles its initial investment in the country announced in 2019.

Air freight carriers WestJet Cargo and Awesome Cargo, meanwhile, aim to boost connectivity between Felipe Ángeles International Airport in Mexico and the rest of North America, according to a Nov. 20 emailed press release.

“While the partnership is not explicitly tied to nearshoring, it does position both companies in a favorable position to leverage existing trade agreements and strengthen trade connections,” a WestJet spokesperson told Supply Chain Dive in an email.

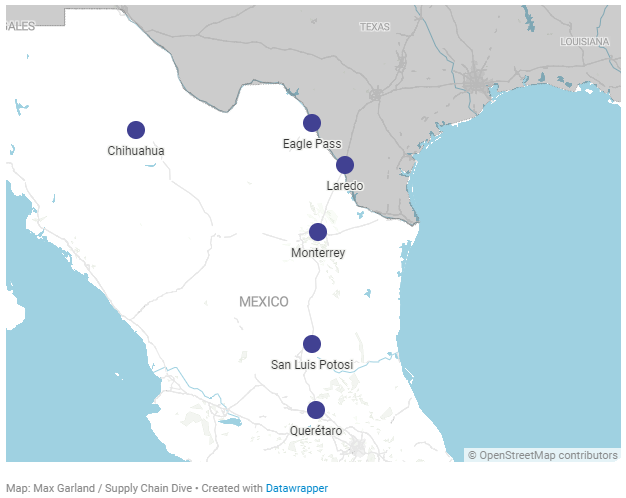

Logistics companies have announced investments in Texas to take advantage of manufacturing growth across the border in Mexico.

Intermodal services out of Mexico grow

Railroads and trucking companies are ramping up partnerships to capture demand from North American supply chain investments and the U.S.-Mexico-Canada Agreement, tapping into each other’s networks to offer comprehensive services between the three countries.

Logistics companies up border gateway capabilities as manufacturers grow in Mexico

Recently announced investments in Mexico and the Texas cities of Eagle Pass and Laredo

Union Pacific, for example, launched the “Falcon Premium” Mexico-to-Canada intermodal service with Canadian National and Grupo Mexico Transportes earlier this year. The offering connects parts of their networks to support shipments of auto parts, food and temperature-controlled freight.

Union Pacific’s trucking partner Hub Group also expects to see benefits from the arrangement.

“We are really excited about the southern premium service that just got launched by our western partner Union Pacific,” President and CEO Phil Yeager said during the company’s Q1 earnings call in April. “It’s really going to help us, I think, take advantage of the nearshoring opportunity both in the near-term as well as longer-term.”

The Falcon Premium combination faces stiff competition from Canadian Pacific Kansas City, the first single-line railroad to link the U.S., Mexico and Canada, and its partnership with trucking provider Schneider National.

Schneider’s intermodal business in Mexico is currently a “very small part of our book,” EVP and CFO Stephen Bruffett said in a November earnings call, but it’s growing. The carrier’s order count has already grown by 20% on its service with CPKC in and out of Mexico.

“The percent of increase is much higher as well as the overall market growth in Mexico, driven by nearshoring,” Bruffett said. “So the incremental volume is still relatively small, but we’d say that longer-term opportunity is larger.”

That forward-looking mindset is shared by numerous carriers across transportation modes, as they rework their sprawling networks for a new era in supply chains.

Source : supplychaindive.com